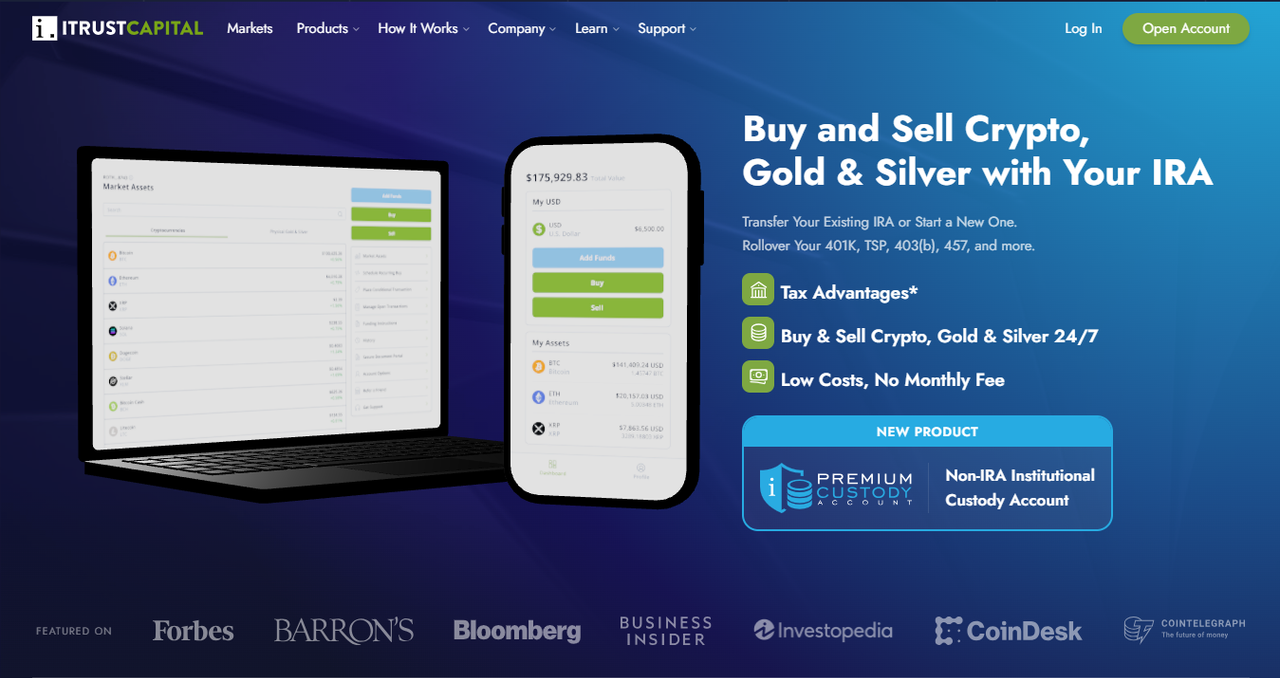

iTrustCapital — Sign In to Premium Crypto Exchange Access

Securely sign in to manage cryptocurrency, retirement accounts, and institutional-grade services. Our platform blends high-assurance custody, transparent reporting, and friction-free fiat rails so you can invest, trade, and track assets with confidence and clarity.

Why iTrustCapital Sign-In Matters

Signing in to iTrustCapital is the gate to a managed, secure environment built for both retail investors and institutional participants. The sign-in process is more than a credential check — it is a sequence of protections that ensures the session is verified, the device is recognized, and the user is authenticated with layered controls. We deploy strong password hashing, multi-factor authentication, device fingerprinting, and anomaly detection to reduce the risk of account compromise. For institutional users, additional role-based access controls, API key scoping, and withdrawal whitelists provide the granular protections required for treasury operations and advisory workflows.

Premium Features Available After Sign-In

Institutional Grade Custody

Assets are held with segregated cold storage via audited custodians, backed by insurance programs where available. This reduces counterparty and theft risk while maintaining rapid access to on-chain liquidity when trades or withdrawals are required.

Streamlined Fiat On/Off Ramps

Deposit and withdrawal rails are simplified with transparent fees and settlement options. Link bank accounts securely, verify identity quickly, and manage fiat liquidity to fund trading strategies without unnecessary friction.

Advanced Reporting & Tax Tools

Download tax-ready statements, export trade history, and use built-in analytics to understand portfolio performance. Our reporting tools make reconciliation straightforward for both individual investors and advisors managing multiple client accounts.

Enhanced Access Controls

Configure multi-user team accounts, set role-based permissions, and enforce withdrawal whitelists. Control who can trade, who can view balances, and who can initiate transfers to improve operational security.

Getting Started — Secure Onboarding

New users complete identity verification (KYC), link bank accounts, and enable recommended security defaults during onboarding. We guide you through enabling two-factor authentication (2FA), setting up trusted devices, and applying withdrawal limits. Institutional accounts go through an expanded verification process including corporate documentation, authorized signers, and compliance attestations to ensure account setups meet regulatory requirements. Follow the onboarding prompts carefully, store your credentials safely, and use the recovery methods provided to ensure you can regain access if needed.

Common Sign-In Questions

Q: What happens if I lose my device?

A: Initiate the account recovery flow immediately: disable active sessions, revoke any API keys, and contact support for expedited identity verification. We recommend pre-registering recovery contacts and using hardware-backed 2FA to reduce recovery friction.

Q: Is there insurance on custodial assets?

A: iTrustCapital partners with insured custodians; coverage terms depend on the specific custody arrangement and asset class. Review custody disclosures for detailed information and consider diversifying custody approaches for long-term holdings.

Best Practices for Secure Sign-In

Always enable multi-factor authentication and prefer hardware-backed second-factor devices when available. Use unique, high-entropy passwords stored in a reputable password manager. Avoid logging in from public Wi-Fi networks without a trusted VPN, and verify the domain and TLS certificate before entering credentials. Regularly review account activity logs, revoke unused API keys, and set withdrawal whitelists to limit exposure if an account is ever compromised. For high-value holdings, consider cold custody or multisig solutions rather than leaving assets on exchange-side custody.

Troubleshooting Sign-In Issues

If you encounter sign-in problems, start by confirming your email and password combination and verifying any 2FA codes. Clear cached credentials in your browser or try an incognito window to rule out extension interference. If email-based recovery is required, follow the secure reset flow — expect identity verification if risk factors are detected. For account lockouts or suspicious activity, contact support immediately and provide the context requested by our security team to expedite safe recovery.

Responsible Use & Risk Management

Cryptocurrency markets are inherently volatile. Use risk management tools such as stop limits, position sizing, and portfolio hedges where available. Maintain an allocation strategy aligned with your financial goals and appetite for risk. For retirement accounts or large institutional exposures, consult qualified advisors and consider custody diversification to mitigate third-party risks. iTrustCapital seeks to provide the tools you need, but ultimate responsibility for investment decisions and risk management remains with the user.